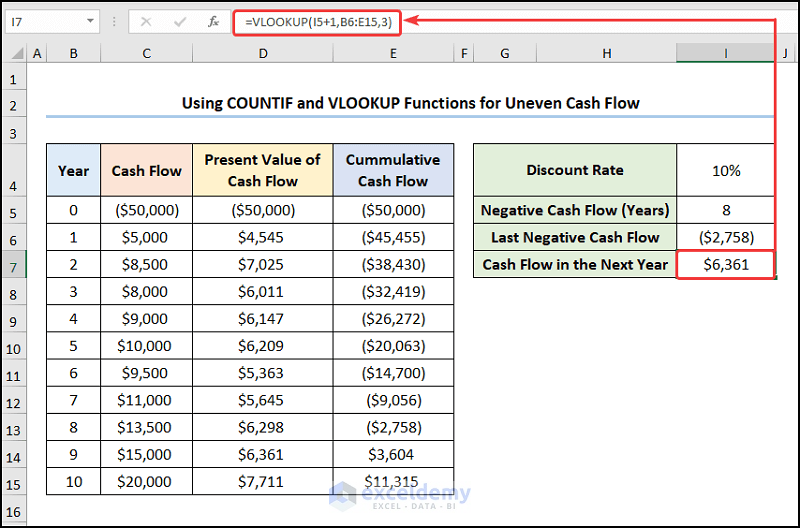

The decision whether to accept or reject a project based on its payback period depends upon the risk appetite of the management. Now we’ll use the IF and AND functions to calculate the Payback Period with Uneven Cash Flows. Again, we’ll need to calculate the cumulative cash flow from the given information first. Uneven cash flow simply means the cash inflow of a current account is not constant and can change over time.

- People and corporations mainly invest their money to get paid back, which is why the payback period is so important.

- The PbP answers the question how much time it takes until thecumulated net cash flows offset the initial investment.

- It’s similar to determining how much money the investor currently needs to invest at this same rate in order to get the same cash flows at the same time in the future.

- This inserts the first entry for the cumulative cash flow calculation.

Payback method with uneven cash flow:

Perhaps in his case the profit might be worth it, depending on what else is going on in his business. However, it’s likely he would search out another machine to buy, one with a longer life, or shelf the idea altogether. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

Investment

Therefore, the cumulative cash flow balance in year 1 equals the negative balance from year 0 plus the present value of cash flows from year 1. Identify the last year in which the cumulative balance was negative. The discounted payback period is calculated by adding the year to the absolute value of the period’s cumulative cash flow balance and dividing it by the following year’s present value of cash flows.

Advantages and disadvantages of payback method:

Payback period means the period of time that a project requires to recover the money invested in it. The payback period is favored when a company is under liquidity constraints because it can show how long it should take to recover the money laid out for the project. If short-term cash flows are a concern, a short payback period may be more attractive than a longer-term investment that has a higher NPV. Although calculating the payback period is useful in financial and capital budgeting, this metric has applications in other industries.

Decision Rule

After entering this formula, no Payback Period value will be displayed in cell E6. The formula will only show the payback period after the last period of the payment cycle. The payback period approach is very useful to a small business with limited financial resources. ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. We provide tips, how to guide, provide online training, and also provide Excel solutions to your business problems. Financial modeling best practices require calculations to be transparent and easily auditable.

The basic difference between even and uneven cash flows is that in even cash flows, the payments are equal over a given period, whereas the payment amounts can be different in uneven cash flows. A large purchase like a machine would be a capital expense, the cost of which is allocated for in a company’s accounting over got tips better report them many years. No such adjustment for this is made in the payback period calculation, instead it assumes this is a one-time cost. According to payback method, the equipment should be purchased because the payback period of the equipment is 2.5 years which is shorter than the maximum desired payback period of 4 years.

The sooner the break-even point is met, the more likely additional profits are to follow (or at the very least, the risk of losing capital on the project is significantly reduced). The IF function checks whether the output returned from the AND function is TRUE. If it is TRUE, then it will execute the next argument of the formula. He’ll have no sooner finished paying off the machine, then he will have to buy another one.

However in some cases, a longer payback period is acceptable or even preferred. At the same time, the payback period requires adjustment to coincide with the project completion time. One can assess how long funds will be committed to a project and whether or not that amount of time constitutes a risk to that endeavor.

If our dataset is large, we won’t be able to find the last negative cash flow manually. Investors may use payback in conjunction with return on investment (ROI) to determine whether or not to invest or enter a trade. Corporations and business managers also use the payback period to evaluate the relative favorability of potential projects in conjunction with tools like IRR or NPV. The payback period disregards the time value of money and is determined by counting the number of years it takes to recover the funds invested.

The easiest method to audit and understand is to have all the data in one table and then break out the calculations line by line. A longer payback time, on the other hand, suggests that the invested capital is going to be tied up for a long period. The AND function returns a logical TRUE or FALSE depending on the conditions given as arguments inside the function. If both of the conditions are met, it will return TRUE, otherwise, it will return FALSE.